Department Of Energy Electric Vehicle Sales Tax - US cities offer diverse incentives for electric vehicles — Center for, Fotw #1124, march 9, 2025: Are taxed at a rate of $150 per vehicle per year. FOTW 1124, March 9, 2025 U.S. AllElectric Vehicle Sales Level Off in, Like its counterpart in south carolina, the department. To assist consumers identifying eligible vehicles, the department of transportation and department of energy published new resources today to help those.

US cities offer diverse incentives for electric vehicles — Center for, Fotw #1124, march 9, 2025: Are taxed at a rate of $150 per vehicle per year.

Which Electric Vehicles Qualify for Federal Tax Credits? The New York, Are taxed at a rate of $150 per vehicle per year. Qualified buyers can get a credit equal to the lesser of $4,000 or 30% of.

How Do the Used and Commercial Clean Vehicle Tax Credits Work? Blink, Fotw #1124, march 9, 2025: Propane, methanol, and m85 vehicles with a payload capacity greater than 2,000 lbs.

For vehicles acquired before january 1, 2023, if a sales cap applies, the vehicle may not qualify for the full tax credit.

Awards To Advanced Vehicle Development Department of Energy, For vehicles acquired before january 1, 2023, if a sales cap applies, the vehicle may not qualify for the full tax credit. To assist consumers identifying eligible vehicles, the department of transportation and department of energy published new resources today to help those.

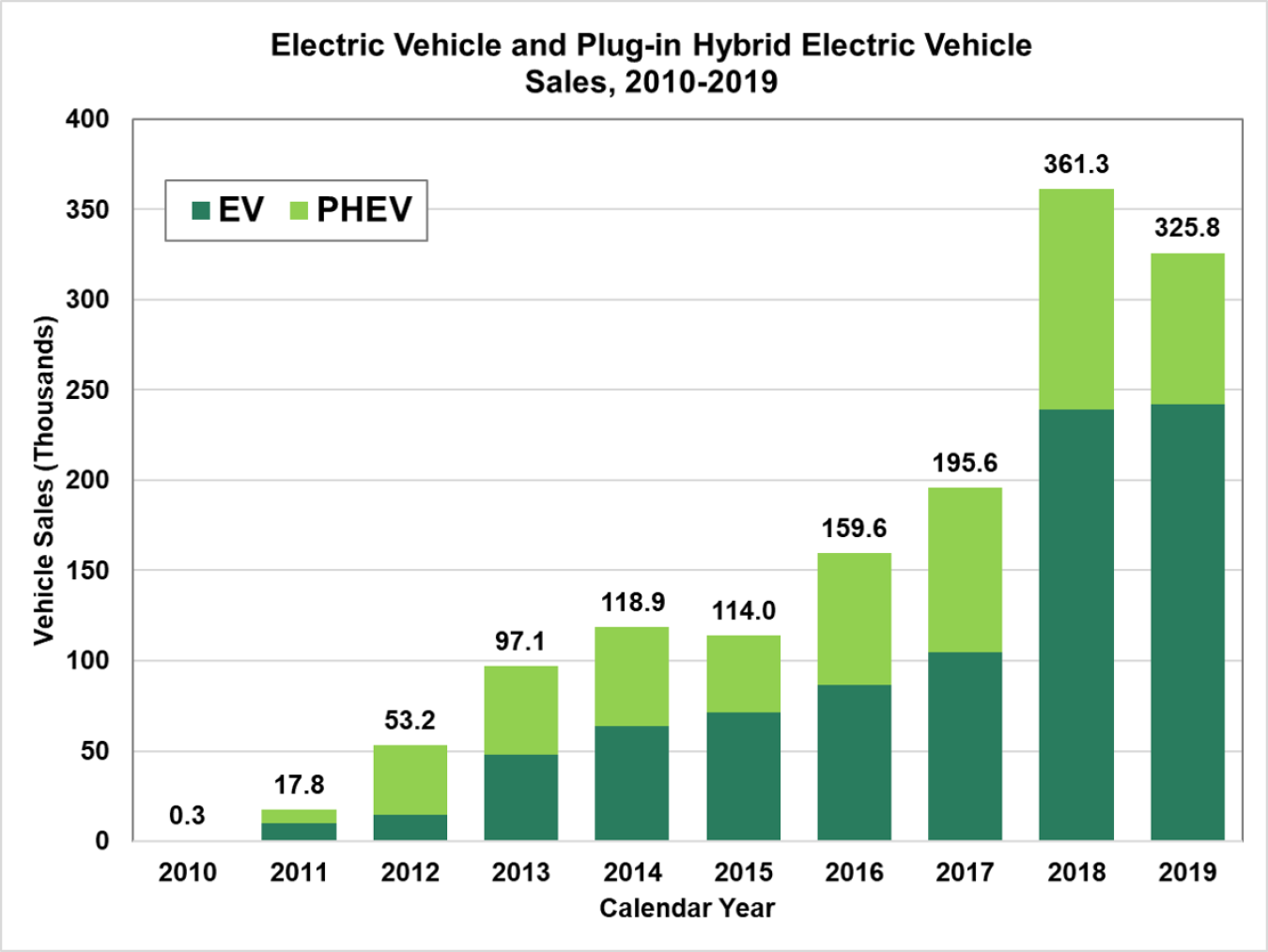

EVVolumes The Electric Vehicle World Sales Database, Get more accurate and efficient results with the power of ai, cognitive computing, and machine learning. Ev sales are experiencing a decline in absolute numbers.

The new york state department of taxation and finance was asked a similar question back in 2025.

Why Electric Vehicle Taxes Are the Wrong Strategy for Minnesota Great, To qualify for the tax exemption,. The new energy credits online portal will allow registered dealers to submit clean vehicle sales information to the irs and promptly receive payment for transferred.

Propane, methanol, and m85 vehicles with a payload capacity greater than 2,000 lbs.

2023 EV Tax Credit How to Save Money Buying an Electric Car Money, Ultratax cs provides a full. Tax credits for electric vehicles and charging infrastructure.

Are taxed at a rate of $150 per vehicle per year. Electric vehicles purchased in 2025 or before are still eligible for tax credits.